The Global Big Data Analytics in Agriculture Market is growing rapidly as farmers and agribusinesses adopt digital tools to improve crop yield, optimize resource usage, and enhance decision-making. Agriculture has entered a data-driven era, where advanced technologies like artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and predictive analytics are being leveraged to transform traditional farming practices.

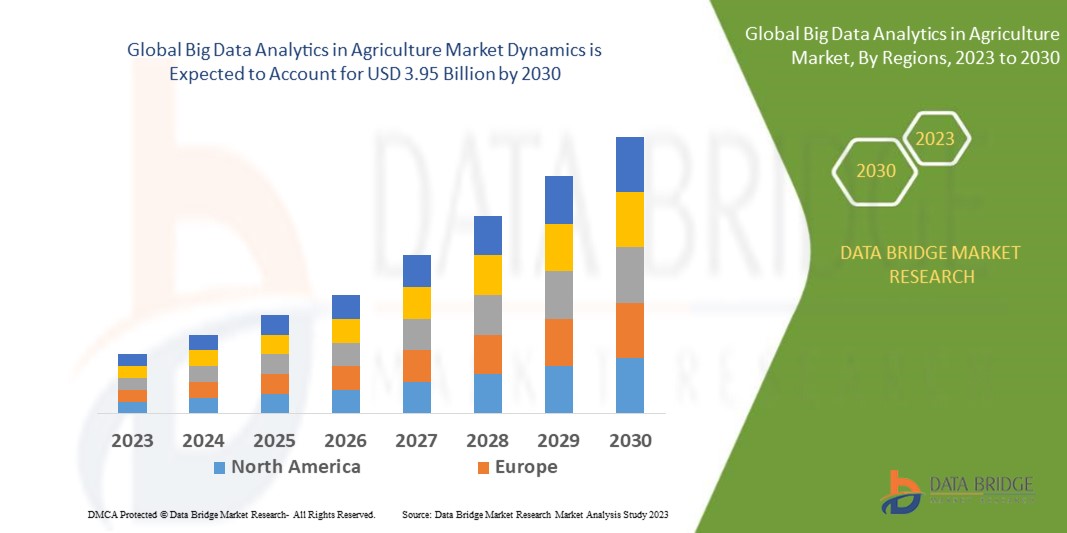

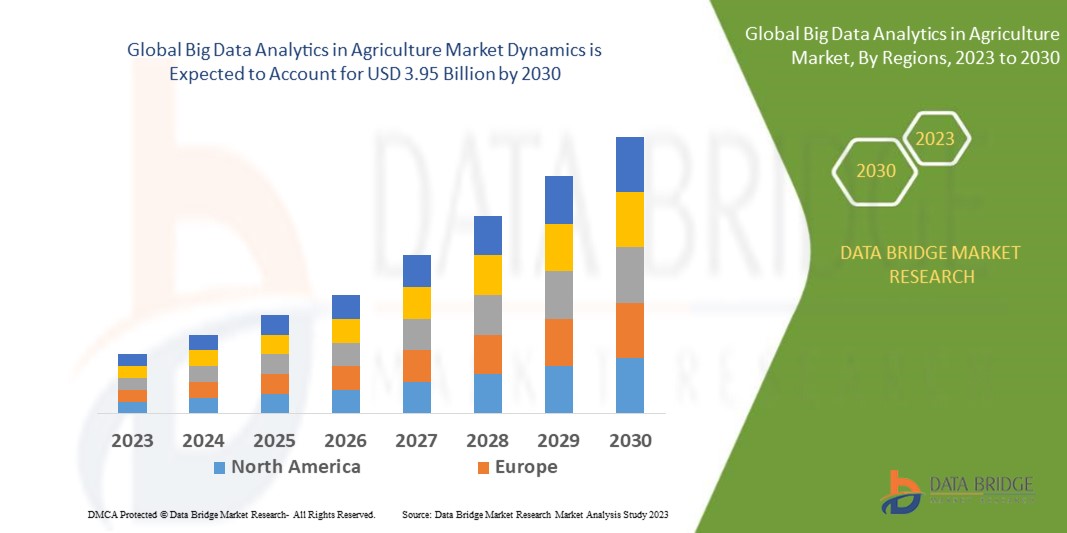

Data Bridge Market Research analyses that the global big data analytics in agriculture market which was USD 1.24 billion in 2022, is expected to reach USD 3.95 billion by 2030, and is expected to undergo a CAGR of 15.60% during the forecast period of 2023 to 2030. Rising global food demand, climate change challenges, and the need for sustainable farming practices are fueling the adoption of big data solutions in agriculture.

The Big Data Analytics in Agriculture Market is shaped by strong drivers and opportunities. The growing global population is increasing the demand for food production, placing pressure on farmers to maximize yields with limited resources. Big data analytics provides actionable insights into soil health, crop conditions, weather patterns, and market demand, enabling precision farming practices.

IoT sensors, drones, and satellite imagery generate massive datasets that, when analyzed, help optimize irrigation, fertilizer use, and pest management. This not only improves efficiency but also reduces costs and environmental impacts.

Government initiatives promoting smart farming, along with subsidies for digital agriculture adoption, are further supporting market growth. Large agribusinesses and smallholder farmers alike are adopting big data solutions to remain competitive and resilient.

However, the market faces challenges such as high implementation costs, lack of digital literacy among rural farmers, and concerns over data privacy. Despite these hurdles, the integration of cloud-based platforms and mobile apps is making big data solutions more accessible, especially in developing economies.

The Global Big Data Analytics in Agriculture Market can be segmented by component, application, and end-user.

By component, the market is divided into software, hardware, and services. Software solutions, including predictive analytics platforms, farm management systems, and visualization tools, dominate the segment. Hardware such as sensors, drones, and connected devices also contribute significantly, while services like consulting, integration, and training are crucial for effective adoption.

By application, key areas include crop monitoring, yield prediction, soil analysis, weather forecasting, farm equipment management, and supply chain optimization. Crop monitoring and yield prediction hold the largest share as farmers increasingly rely on data to forecast production and market pricing.

By end-user, the market serves farmers, cooperatives, agribusiness corporations, government agencies, and research institutions. Large-scale agribusinesses are currently the biggest adopters, while small and medium-sized farms represent a fast-growing segment due to rising awareness and affordability of digital solutions.

The Big Data Analytics in Agriculture Market displays varied growth across regions.

North America leads the market, driven by advanced digital infrastructure, high adoption of precision agriculture, and strong investments in agri-tech startups. The United States is the largest contributor, with widespread use of big data solutions across large farms.

Europe follows closely, supported by government policies promoting sustainable farming and advanced farming practices in countries like Germany, France, and the Netherlands. Strict regulations around pesticide use and resource efficiency are boosting demand for data-driven solutions.

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Rapid population growth, food security concerns, and government initiatives to promote smart farming are accelerating adoption. China’s large agricultural sector and India’s increasing digital literacy are key contributors.

The Middle East and Africa are gradually adopting big data technologies, particularly in regions facing water scarcity and food production challenges. In South America, Brazil and Argentina are embracing data-driven agriculture for large-scale crop production, especially in soybean and corn farming.